Our Platform

ROSE OAK was established by Nigel J Lewis in November 2003 in order to facilitate a management buy-out (MBO) of the investment management business he established in 1998 during his time with a leading Australian private investment bank.

POSITIONED to be an independent, investment advisory and management specialist, the ROSE OAK platform has the boutique discipline, work-passion and cost-base associated with a single focused, owner-operated investment practice and most importantly none of the potential conflicts associated with affiliated, commission-based, or volume-of-funds-based business models.

STRUCTURED as a small scale, wholesale financial services business, ROSE OAK holds an Australian Financial Services Licence (AFSL No. 255291). ROSE OAK is independent and provides advice and management through agreements directly with its clients.

ROSE OAK’S FOCUS is only on managing and advising capital for a select number of high-net worth clients, corporates and family offices (wholesale clients as that term is defined in the Corporations Act). ROSE OAK does not deal with or advise retail clients.

WITH A STRATEGY to limit the number of clients and consequently the total funds under management and advice, ROSE OAK is positioned to maintain high levels of client service, risk controls and compliance, whilst remaining focused on wealth creation and capital preservation through investment management and advice.

THE ROSE OAK PLATFORM enables us to remain focused on our passion of seeking out, selecting and blending investment opportunities and importantly to perfectly align the crews’ interests with those of its clients. This alignment is reinforced by bearing both financial and reputation risks.

OUR INFRASTRUCTURE utilises cloud-based technologies and multiple back-up protocols in order to efficiently and cost-effectively manage our portfolios, investment research and compliance needs, anywhere, at anytime.

OUR PLATFORM AND PROCESS is built to firstly help us seek out and gather diverse views from the broadest of alternatives.

Simplicity is under-rated by too many investors. Many investors focus only on what they know with confidence, have gained from their own personal (or recent) experience or from people in authority (e.g the CEO). This leads many to distort their views of the future to match only those imposed views.

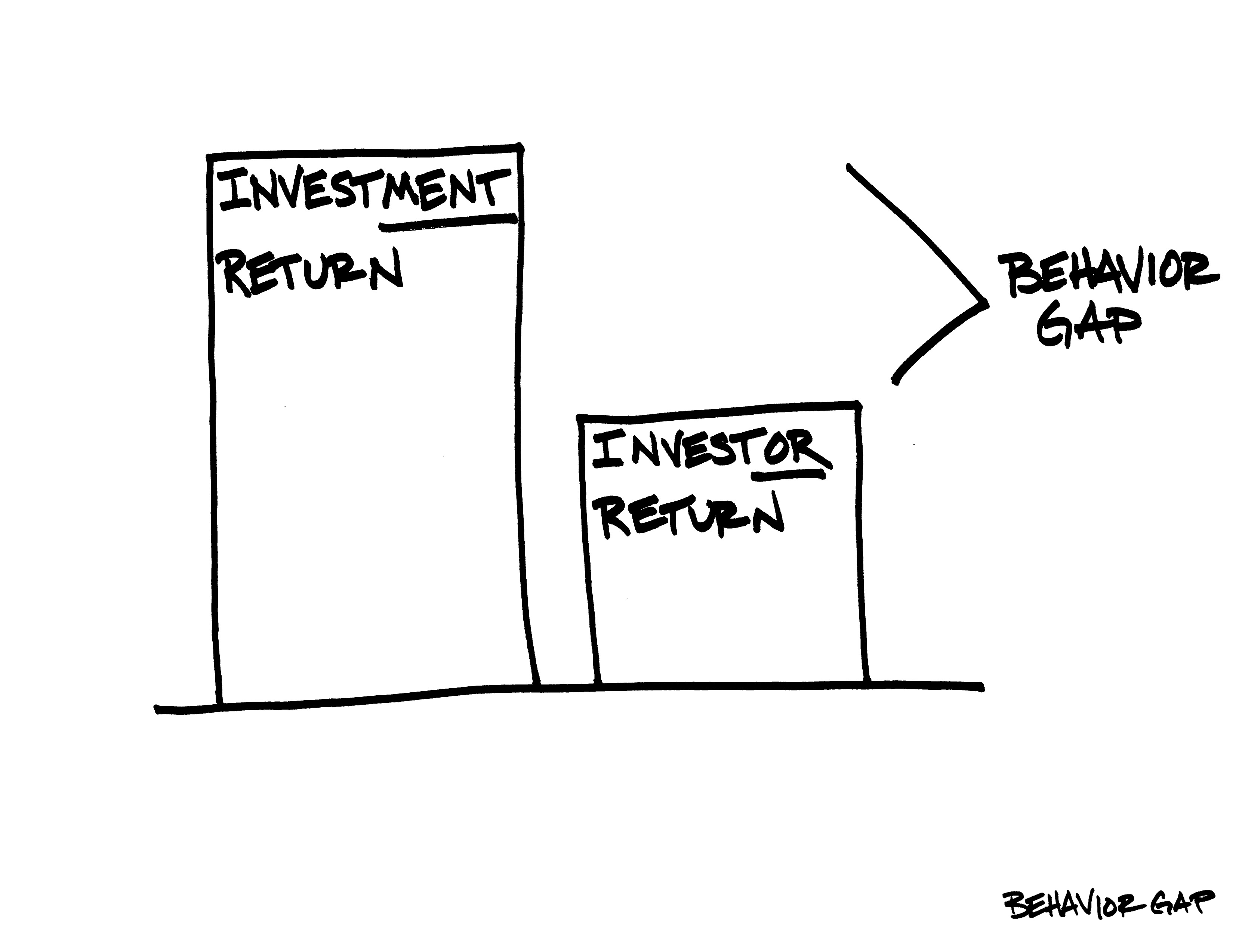

We aggregate and analyse data and make decisions within a ‘ROIC-framework’ acutely aware of the behavioural errors we are all prone to make as decision makers.

DECISION MAKING is at the core of our process. Corporate and behavioural finance are both paramount to successful, consistent and long-term investing. Data, knowledge, time and skill are all critical ingredients to our successful investing. However decision-making awareness and behavioural management of our judgements, actions and perceptions are critical when dealing with the uncertainty of the future (i.e. investing).